has capital gains tax increase in 2021

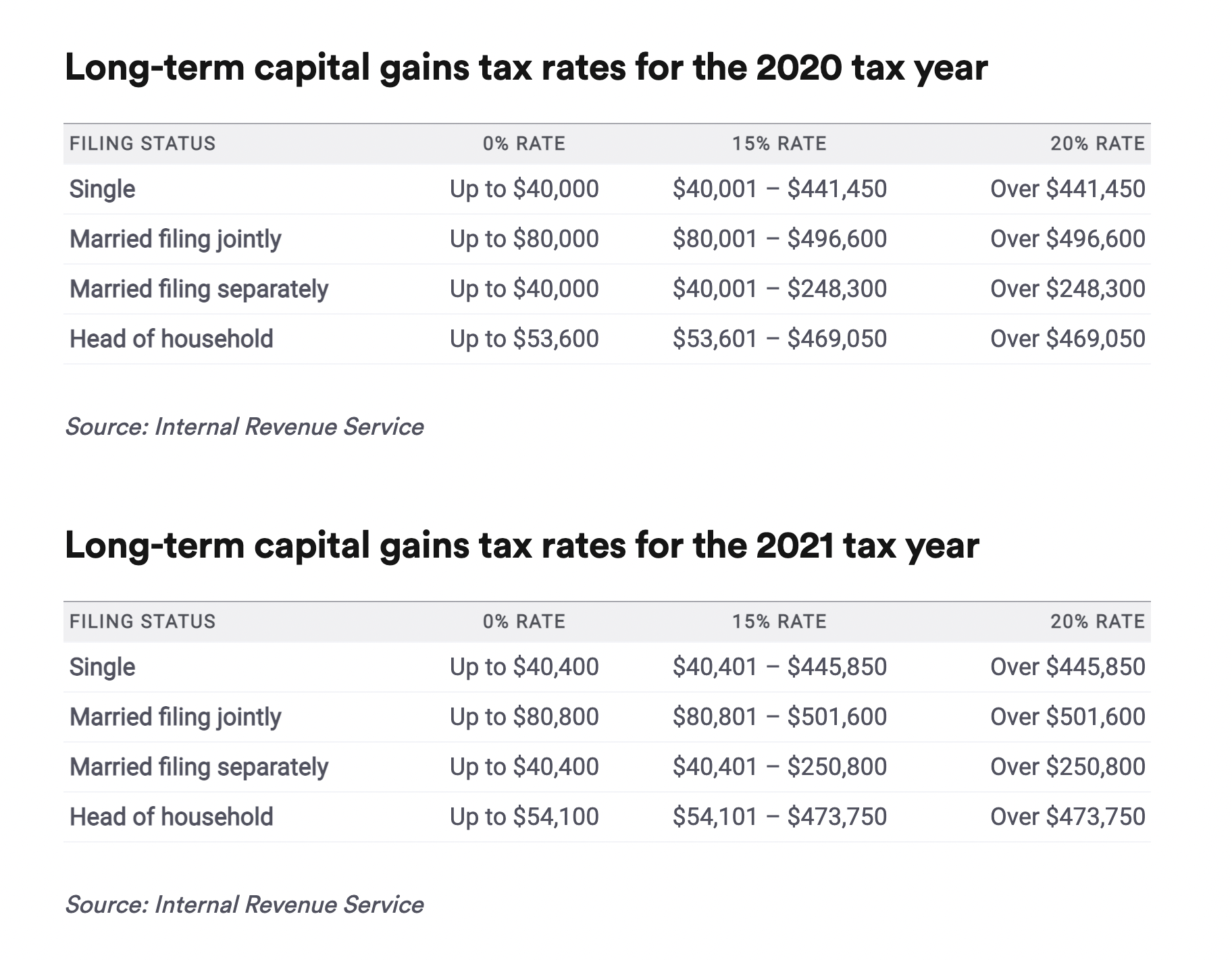

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. 23 2020 CNW - Vanguard Investments Canada Inc.

Short Term And Long Term Capital Gains Tax Rates By Income

Ad Donate appreciated illiquid assets and give even more to charity.

. 4 rows Capital Gains Taxes on Collectibles. Posted on January 7 2021 by Michael Smart. With Covid-19 causing financial devastation across the country.

Analyze Portfolios For Upcoming Capital Gain Estimates. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Thats an increase of 1800 or a 7 bump.

Capital Gains Tax Rates 2021 To 2022 The federal income tax rate which will apply to your gains from stock sales mutual funds or any of your other capital assets will depend. To address wealth inequality and to improve functioning of our tax. The sharp rise in tax payments reflects an unprecedented surge in 2021 income including double-digit stock market gains according to the analysis.

Its time to increase taxes on capital gains. Ad If youre one of the millions of Americans who invested in stocks. Filers paid hundreds of.

Schwab Charitable has been supporting charitable giving since 1999. If you realize long-term capital gains from the sale of. However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable income.

Take for example the 22 bracket for single taxpayers. This is known as your capital gains tax allowance. Capital gains taxes.

He would receive 67328 from the VA which would be tax. SEE MORE IRS Releases Income Tax Brackets for 2021. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

Long-term capital gains are taxed at their own long-term capital gains rates which are less than most ordinary tax rates. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. Gassman said an increase of the top tax rates.

For tax year 2022 for family coverage the annual deductible is not less than 4950 up from 4800 in 2021. However the deductible cannot be more than 7400 up 250 from the limit for. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate.

Taxes and Asset Types - Investopedia 1 week ago Dec 21 2021 Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth. Company tax rates 202122 Corporate tax rate 32 Branch income tax 32 Diamond mining companies 55 Mining Companies other than diamond mining companies 375 Long term. For the 2021 tax year the bracket ranged from 40526 to 86375 and covered 45849 of taxable income 86375.

For married couples filing jointly the standard deduction will rise to 27700 up from 25900 in the current tax year. Today announced final annual capital gains distributions for the Vanguard ETFs listed below for. What is the capital gains exemption for 2021.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. For example if you had 900000 in wages and 200000 in long-term capital gains 100000 of the capital gains would be taxed at the current long-term capital gains tax rate.

VA Disability Rates WILL increase in 2021. Please continue to check back. There are seven federal income tax rates in 2023.

The Tax Policy Agenda Preparing For Possible Capital Gains Tax Increase 8 3 2021 The Tax Policy Agenda What Businesses Need To Know

New Capital Gains Tax Increases And Home Sales Osprey Accounting Services

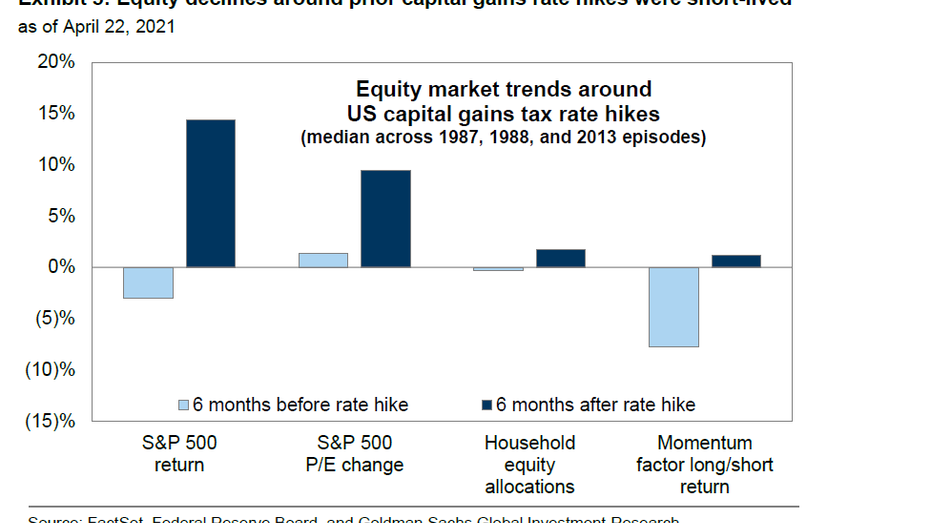

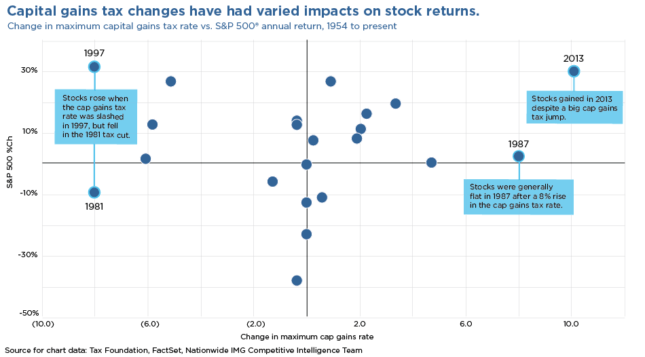

Capital Gains Hike Won T Affect Stock Market Experts Say But Wealthy Scramble

Capital Gains Tax Hikes And Stock Market Performance Fox Business

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Concerns Rise Over Tax Increase Proposals Nationwide Financial

Capital Gains Tax Archives Skloff Financial Group

12 Ways To Beat Capital Gains Tax In The Age Of Trump

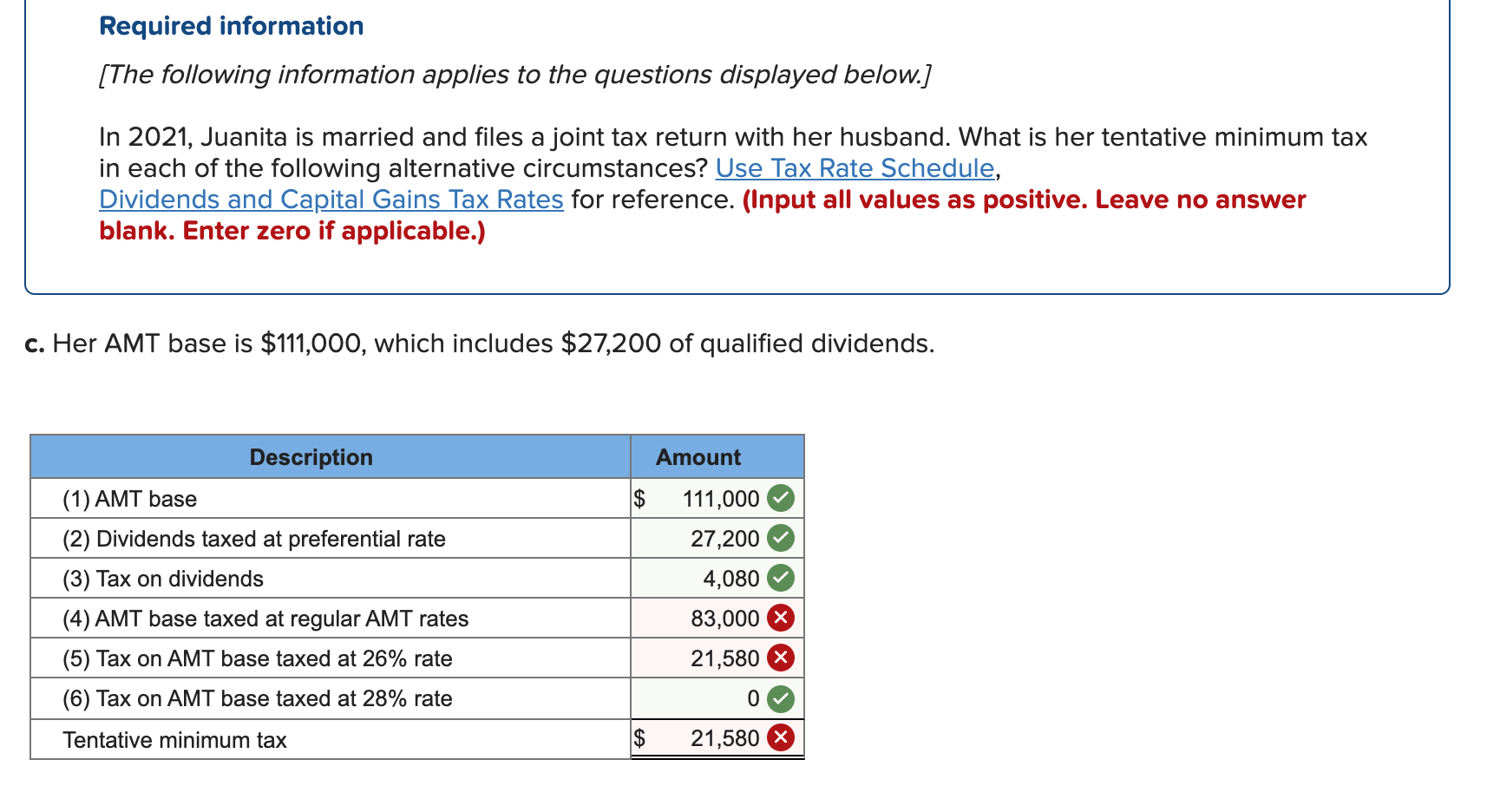

Solved Required Information The Following Information Chegg Com

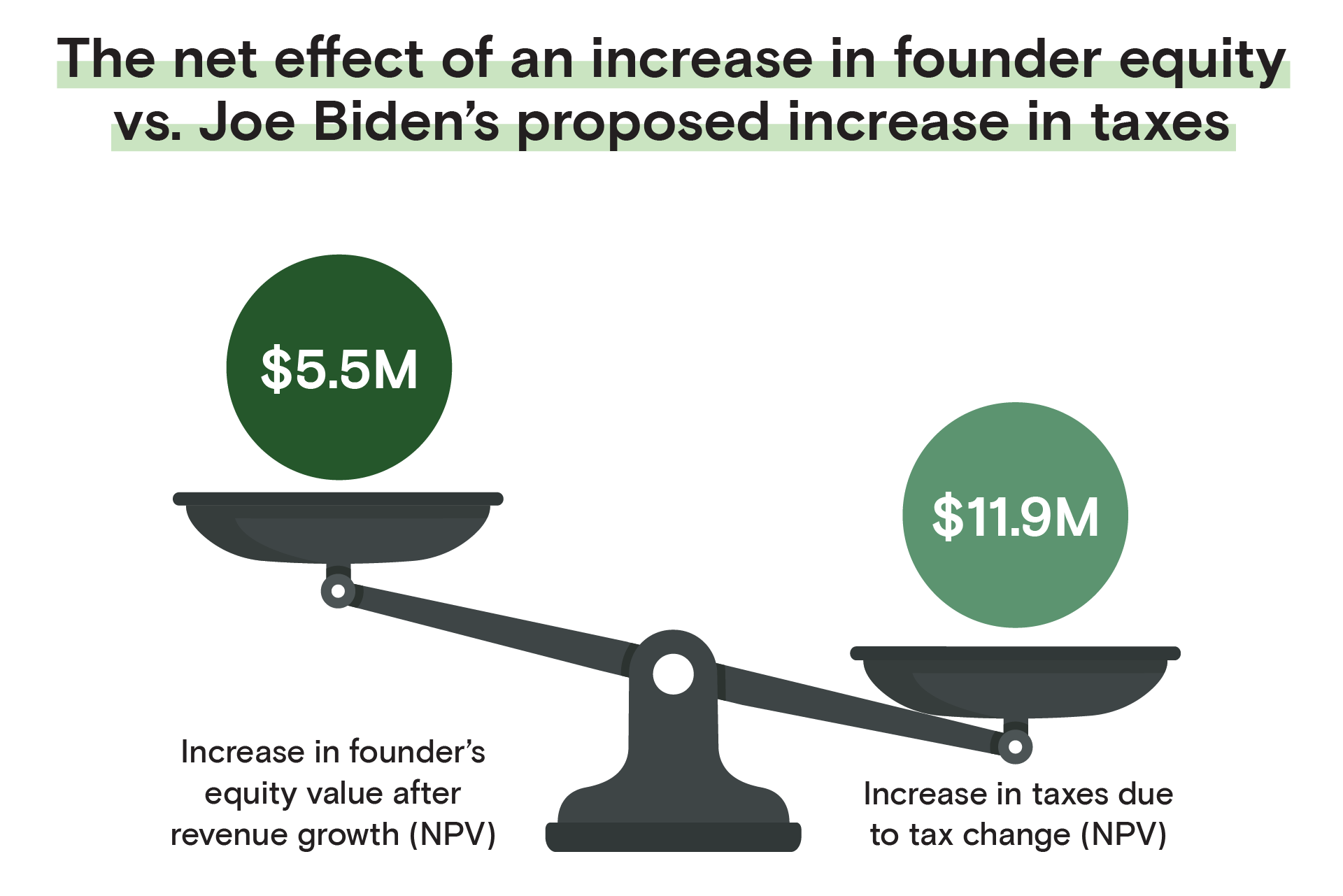

For Founders The Implications Of Joe Biden S Proposed Tax Code

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

It S Time To Repeal This Unfair Tax Giveaway New Mexico Voices For Children

Crypto Tax 2021 A Complete Us Guide Coindesk

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge